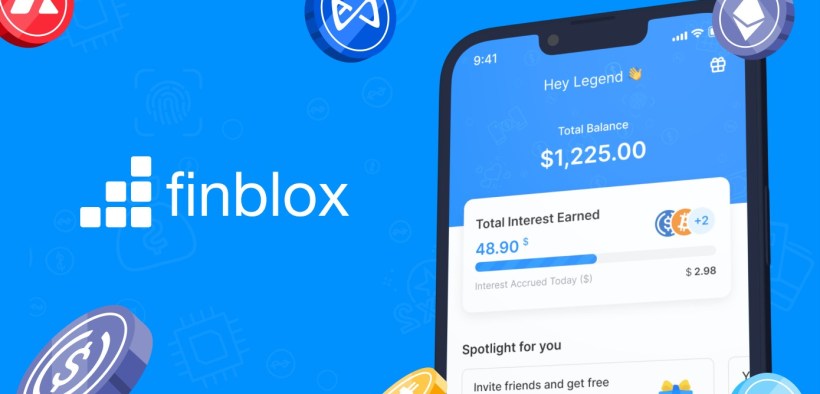

Finblox Presents Crypto Asset Management Platform, Books 56 Billion Rupiah Funding

Share

Hong Kong-based crypto asset management platform, Finblox, managed to book an initial funding of $3.9 million or the equivalent of 56 billion Rupiah. The company has a primary focus on simplifying crypto asset management in more than 100 emerging markets.

The round closed in two terms, involving strategic investors and managed funds focused on crypto and fintech.

The fresh funds raised from this round will be used to accelerate the growth of the platform, including developing talent in the technical and product teams. In addition, some of the funds will also be used to accelerate the process of complying with regulations, marketing initiatives, and market education.

Finblox Service

Finblox is focused on providing easy and secure asset management services to popular stablecoins and crypto assets in emerging markets such as Axie Infinity and Polygon.

The platform allows users to passively earn returns on their assets and has no restrictions on minimum balances or withdrawal periods. Since launching in December 2021, the platform has been available to users in more than 100 countries.

The company is also said to have experienced a quadruple growth in assets under management since early 2022, and 90% of its registered users are from developing countries, mostly Southeast Asia. In addition, the interest rates offered are claimed to be the highest available in the digital asset space.

As additional information, Finblox users are promised a 15% annual yield percentage on USD Coin, a stablecoin pegged to the United States dollar.

The app also offers yields of up to 90% on other major cryptocurrencies like Bitcoin, Ethereum, Solana, Avalanche, and Axie Infinity. Refunds are possible through Finblox partnerships with established crypto institutional borrowers and trusted decentralized finance protocols.

The company was founded by veterans Peter Hoang and Dmitriy Paunin. Peter himself is best known as the founder of the stock trading app Gotrade, which is backed by Y Combinator.

Meanwhile Dmitriy Paunin is the Chief Technology Officer at Coins.ph, a Philippines-based Southeast Asian trading company that has amassed more than 16 million users.

Finblox CEO Peter Hoang said, “Our core vision is to democratize wealth building for all, and providing easy access to decentralized finance is the first step.

As well as market-leading rates and daily payments, what sets us apart is our focus on simplifying the on-ramp crypto experience in a safe and secure manner, and providing educational content that empowers the users to hold assets long term instead of trading them.”

Regarding security, user assets are guaranteed and insured by Fireblocks Inc., certified digital asset custodians. In addition, this system is also protected by the crypto insurance platform Coincover.

The company is known for its deep Information Security in the fintech sector and has built a platform that is resistant to most of the issues that customers can face when working with digital assets.

Focus On Indonesian Market

High inflation and low bank deposit rates have fueled a huge surge in worldwide crypto adoption, reaching over 880% in 2021 alone. Vietnam, India, Philippines, Brazil and other emerging markets ranked highest in the global crypto adoption index last year.

However, only a small part of the global population is exposed to crypto. Given the successful adoption despite limited awareness, this represents a huge growth opportunity for apps like Finblox in developing countries.

Dragonfly Capital partner Mia Deng said, “Southeast Asia has developed into one of the most active markets over the past year, but the product infrastructure is still lacking to support the rapidly growing demand. We believe what Peter and Dmitriy have built at Finblox will make a meaningful contribution to crypto ecosystem in Southeast Asia.”

Regarding its focus in Indonesia, Peter said that as a crypto company, Finblox competes on a global scale, not just emerging markets. Indonesia is one of the main targets in the Southeast Asia region because of its enormous potential.